If You Use Fifo Which Disclosures Are Required

The pressure of SOX. First-in-first-out FIFO is not used in day trading calculations.

You sell 125 shares.

. The Booklet is broken down into two main. Otherwise you will be defaulted into First In First Out as your secondary cost basis method. List of Financial Ratios.

If you have a Traditional Rollover SEP or SIMPLE IRA you must take an annual lifetime RMD once you have reached your required beginning date. Shares purchased through dividend reinvestment. You are required to pass qualification exams to demonstrate competence in your particular securities activities.

Per FINRA the term pattern day trader PDT refers to any customer who executes four or more day trades within a rolling five business-day period in a. Please Use Our Service If Youre. Additional fees may apply.

What is an IARD number. Pattern day trader accounts. This is a guide to Financial Statement Examples.

They would not generally be removed especially if any transaction had been posted to the account. As a result the accounting industry has sought ways to automate a previously strenuous manual process. It is probably the most common and straightforward tax lot ID method.

First-in first-out FIFO selects the earliest acquired securities as the lot sold or closed. This means that shares that were bought first are also sold first. The DPWI pays for the tertiary education of 43 young South Africans who are gearing to start their 2022 academic year.

ACST Average Cost. For example lets say you own 200 shares. Requiring help with paraphrasing your scholarly articles and managing plagiarism.

Simply put using this method means that the oldest security lots. Needing assistance with how to format citations in a paper. Here we also discuss the introduction to Financial Statement Examples along with detailed explanation.

Interested in having your paper proofread. By default Fidelity uses first in first out FIFO when selling your shares. RMD rules also apply to employer-sponsored retirement plans including profit-sharing plans 401k plans and 403b plans.

You should review the Booklet and keep a copy for your records. By continuing to maintain your JPMS accounts you are agreeing to the amended terms. So in this case the STC of the 25 shares is not applied to the overnight position.

If you have any questions contact your advisor to discuss. Hypothetical example for illustrative purposes only. Investment Income and Expenses explains the average basis method in more detail.

With FIFO the first 100 shares sold will come from your first batch and the. Wishing for a unique insight into a subject matter for your subsequent individual research. The first 100 were purchased at 10 per share the next 50 at 15 and the final 50 at 20 per share.

A chart of accounts COA is a list of financial accounts set up usually by an accountant for an organization and available for use by the bookkeeper for recording transactions in the organizations general ledgerAccounts may be added to the chart of accounts as needed. Public companies are required to perform these steps as part of their financial close. Integrate the apps you use today and expand your toolkit with access to more than 200 apps Sync QuickBooks with the Salesforce CRM connector Manage your online sales and inventory in one place by integrating your e-commerce channels with QuickBooks Take a product tour.

The Investment Adviser Registration Depository IARD is an electronic system through which investment advisors register themselves and file required reports and disclosures with the US. Roth IRAs are not subject to RMDs while the original account owner is alive. Goodwill of a company depends on its timely disclosures.

ACCOUNT INFORMATION REQUIRED. As well as improve the accuracy of corporate disclosures SOX and other acts like it across the world have increased stress on organisations to comply. Required to select a secondary cost basis method.

Help when you need it with Priority Circle Receive. Dollar amount is divided by the. Federal Securities and Exchange.

Looking to expand your knowledge on a particular subject matter. Absent a specific instruction from you by the settlement date of the sale to utilize a different tax lot ID method we are required by the tax law to apply FIFO. The agreements and disclosures section of the website you use to access your JPMS accounts or is available from your PCA or FA.

You can switch between specific identification and FIFO whenever you wish but once you use one of the average basis methods for a fund youre stuck with it for as long as you own shares in that fund. A method that calculates the gainloss by adding up the number of shares owned as well as the total dollar amount of the shares. You may also have a look at the following articles to learn more Objectives of Financial Statements.

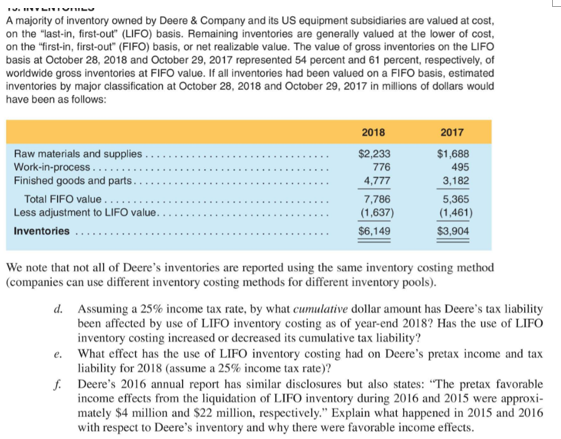

A Majority Of Inventory Owned By Deere Company And Chegg Com

Hypothetical Comparison Of Fifo Versus Lifo Calculation Of Income Tax Download Table

/GettyImages-1155623689-5209b0a3814d41e1b348373c64b66551.jpg)

Does U S Gaap Prefer Fifo Or Lifo Accounting

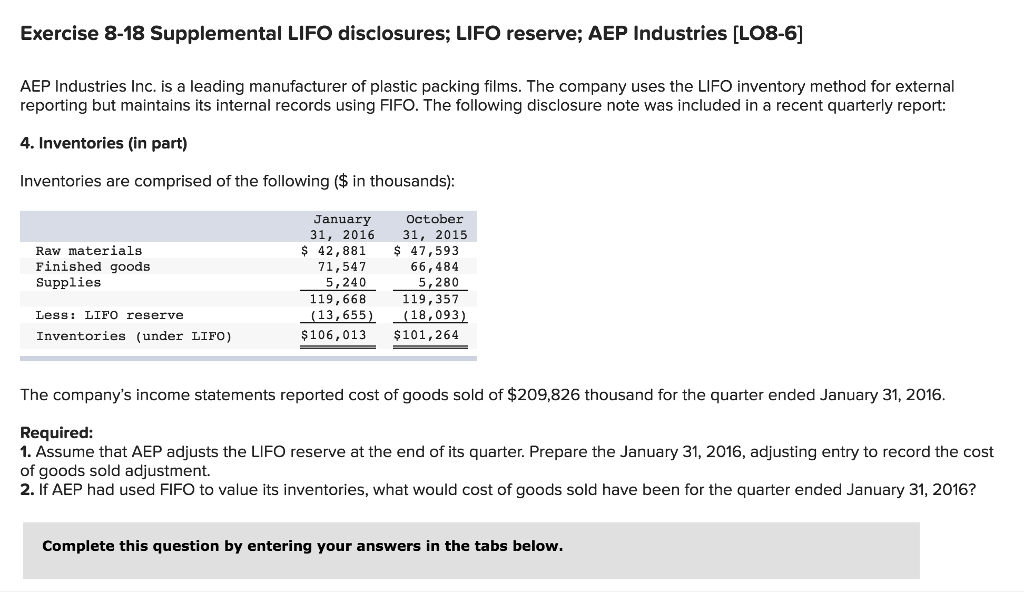

Solved Exercise 8 18 Supplemental Lifo Disclosures Lifo Chegg Com

Comprehensive Example Fifo Perpetual Open Textbooks For Hong Kong

Pre Dispatch Timer Driver App Lyft Request

Trends In Preferability Letters Trends In Preferability Letters Audit Analyticsaudit Analytics

Spot The Difference Fifo Vs Lifo Fifo Stands For First In First Out While Lifo Stands For Last In First Accounting Principles Inventory Accounting Accounting

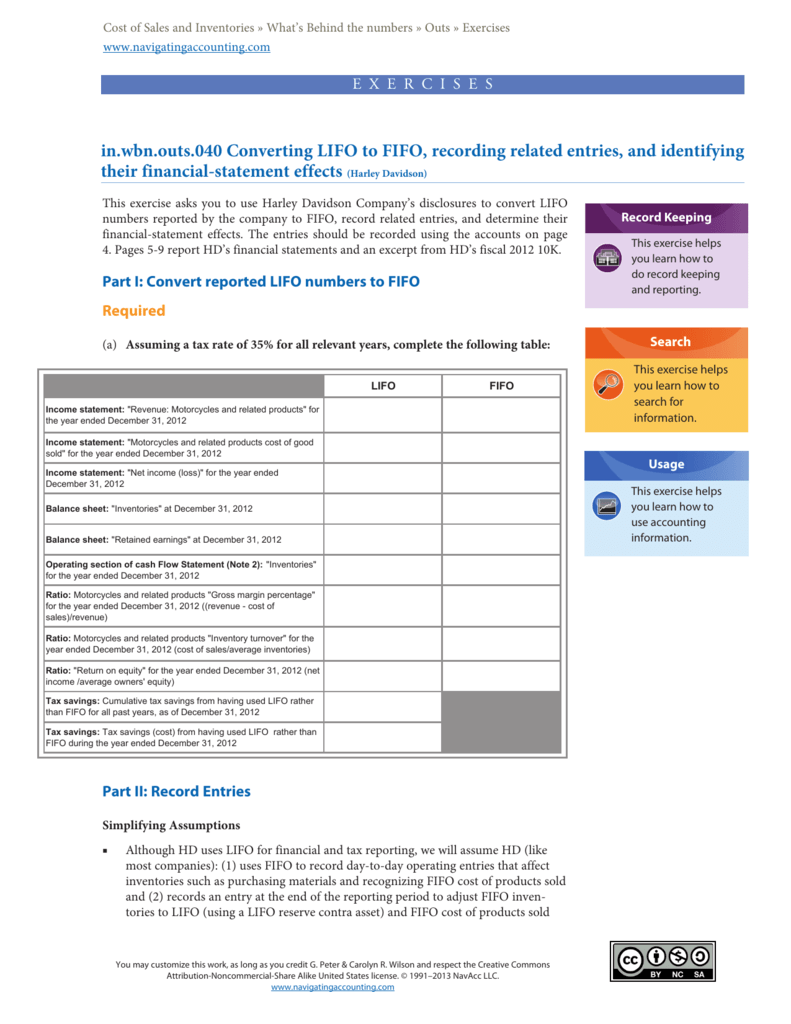

In Wbn Outs 040 Converting Lifo To Fifo Recording Related Entries

Analyzing An Inventory Footnote Disclosure General Electric Company

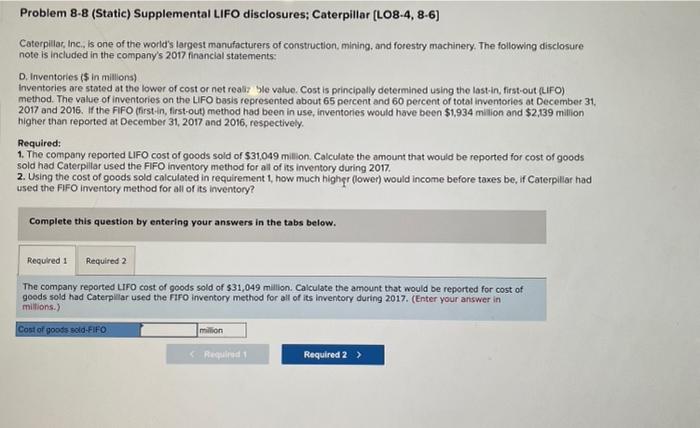

Solved Problem 8 8 Static Supplemental Lifo Disclosures Chegg Com

Depressed Commodities Market May Be The Right Time For Lifo Bkd

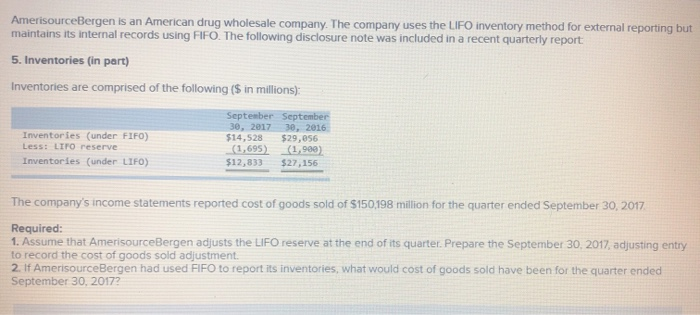

Solved Amerisourcebergen Is An American Drug Wholesale Chegg Com

Details Of The Fifo Lifo Inventory Valuation Methods Method Financial Management Sample Resume

Disclosures For Affiliate Links Termsfeed Marketing Program Disclosure Online Campaign

2022 Cfa Level I Exam Cfa Study Preparation

Fifo Meaning Importance And Example Accounting Education Accounting And Finance Accounting Basics

Comments

Post a Comment